Mortgage Rates on Investment Properties

How to Cash-Out Refinance on Your Investment Property

September 22, 2022What you must know about getting a mortgage for an Investment Property

September 27, 2022

Investment properties offer you the best opportunity to make money from real estate. Unlike residential properties you buy to live in, investment properties are bought to rent out or flip for profit. Investment property loans help investors finance the purchase or development of investment properties.

Buying an investment property is very different from buying a residential property. Lenders typically consider investment properties as higher risk than residential properties. Hence, these lenders tend to place steeper conditions on investment mortgages. This article covers all you need to know about the rates on investment property mortgages.

Investment property mortgage

An investment property mortgage is a loan collected to finance an income-generating property. Also known as rental property loans, investment mortgages are secured by the property being funded. That means if you fail to honor the loan terms, the lender has a right to foreclose your property.

There are various types of investment property loans, including conventional loans, hard money loans, private money loans, and home equity/HELOC loans. Each loan has its unique characteristic, requirements, pros, and cons. However, a general characteristic among these different loans is that they typically have higher rates than residential property mortgages.

Investment property mortgage rates

The mortgage rate is the interest rate you pay on a mortgage loan. This interest is expressed as a percentage of the original loan amount and represents the annual cost of the loan. Mortgage rates can be fixed or variable. As the name implies, fixed mortgage rates remain the same throughout the loan term. Hence, these rates may not reflect the current market rates. For example, if you have a 5% fixed rate, you will continue to pay a 5% interest on your mortgage even if the market rates come down to 3.7%. With an adjustable-rate mortgage, your interest rate continually fluctuates to reflect the current market rates. Both rate types have their pros and cons.

Typically, the rates on investment properties are .50 to .75 percent higher than that on residential properties. For instance, if the average interest rate for a 30-year fixed-rate mortgage on a residential home is around 3.25%, the interest rate on a 30-year loan for investment property will be between 3.75% and 4.0%.

This higher rate covers the higher risk that lenders incur when they loan to investment property investors. Several factors affect the actual rate of an investment mortgage. Factors such as higher down payments, higher credit scores, and shorter terms typically reduce the loan rate. The lender you use and the type of investment loan you take will also impact the mortgage rate. For example, hard money loans typically have higher interest rates than other loan types.

What factors determine the mortgage rates?

Mortgage rates impact the long-term costs of home purchases. Home buyers typically want lower rates to limit spending, while lenders want to maximize profits and limit risks through higher rates. On an individual level, factors like credit history and loan-to-value ratio affect mortgage rates. However, broader economic factors also impact the mortgage ecosystem, and the rates offered. These include;

State of the economy

The economic state of a nation is a huge determinant of mortgage rates. When the economy is unhealthy or declining, it results in inflation. Inflation diminishes the purchasing power of the dollar, thereby affecting true wealth. When there is projected or established inflation, lenders have to set mortgage rates at values that preserve their real profit. For example, if a lender generally sets a mortgage at 3%, and there is an inflation of 1.6%, their true profit becomes 1.4%. To forestall this situation, the lender is forced to set mortgage rates at 4.6 or even 5% to reflect the true 3% profit.

While one may expect economic growth to reflect reduced mortgage rates, this is not the case. Instead, economic growth tends to further increase mortgage rates. In a booming economy (marked by increased GDP and employment rate), more people can meet mortgage requirements, and the demand for mortgages skyrockets. Meanwhile, there is limited cash available to lenders. By law of demand and supply, when demand increases against a stable supply, the price of the item increases. In this case, that price is the mortgage rate, and lenders will use this increased rate to sieve out the best candidates for a mortgage.

Thus, to have a good mortgage rate on investment properties (or any type of property), one would hope that the economy is good enough that there’s no inflation but not too good that everyone can afford a mortgage.

Federal reserve policy

While the federal reserve does not set mortgage interest rates, its policies and actions significantly influence them. The federal reserve can adjust the money supply upwards or downwards. Increases in money supply generally reduce mortgage rates, while reductions in supply achieve the opposite.

Housing market trends

Housing market trends and consumer behavior significantly influence mortgage rates. With increased available houses for sale, there will be an increase in mortgage demand. In this case, the interest rates will go up. Conversely, decreases in available houses reduce demand and thus rates.

Consumer behavior also comes into play. When more people decide to rent rather than buy, there is a reduction in demand, thereby driving mortgage rates down.

Personal factors which lenders factor in to determine mortgage rates for investment properties include;

Your credit score

Lenders typically request higher credit scores for investment property loans. Some lenders may only give you an investment mortgage if you have a credit score of 680 and above, while others may permit a lower score of about 640. However, the general consensus song lenders are to offer you better rates with higher credit scores. Thus, while you may get an interest rate of 5.3% on a 30-year fixed mortgage with a 680 score, the rate may drop to 4.7% with a 740 score.

Credit scores are highly important in determining mortgage rates. Even with hard money loans where the rates are typically high, you are likelier to get a better rate if you have

Your loan-to-value (LTV) ratio

Loan-to-value ratio is calculated by dividing the loan amount needed to purchase a property by the appraised value of the property. A higher LTV means that you put a lower down payment. Lenders generally consider high LTVs as high-risk investments. Thus, mortgage rates increase proportionally to the LTV.

Other factors that impact your interest rate include;

- Debt-to-income ratio

- Cash reserves

Evolution of investment property mortgage rates

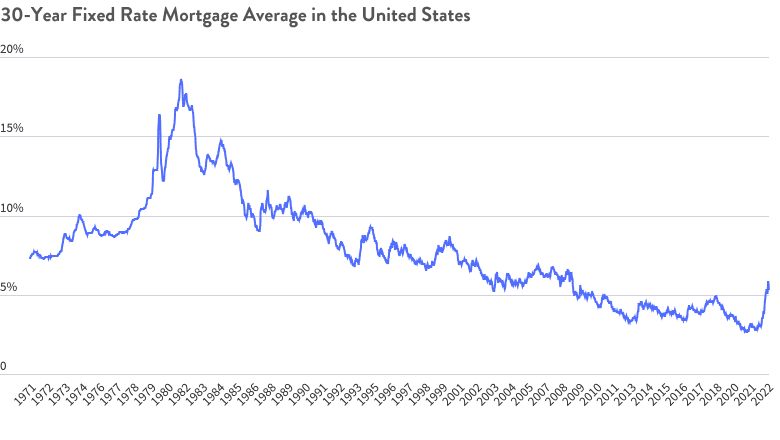

2022 kicked off with an average interest rate of 3.22% for a 30-year fixed-rate mortgage. This rate would have been between 3.72 and 3.97% for investment properties. However, the rates on mortgages have not always been this low. In fact, since the 2020s, mortgage rates have been historically lower than they have ever been.

Mortgages in the US started to gain popularity in the 1970s, peaking in the 1980s. The 30-year and 15-year fixed-rate mortgages have been the most accessed home finance options for residential and investment properties. The average interest rates on these loans have continued to fluctuate since their inception but have remained relatively stable at low rates since the 2010s.

High inflation rates during the 1970s hugely impacted the housing market, with 30-year fixed mortgage rates rising to 11,2% in 1974. Nevertheless, people could obtain mortgages at this time despite the high inflation and mortgage rates. Mortgage rates increased throughout the 1980s as borrowers faced greater volatility and inflation worsened, peaking at 18.63% in 1983 after hitting 16.35% in 1980. The crippling inflation greatly damaged people’s ability to buy homes.

In the 1990s, mortgage rates finally dropped under 10%, allowing homeowners with mortgages from the 1980s to refinance and save money. Early in 1990, rates reached a high of 10.67% before progressively declining for the rest of the decade. Due to the low-interest rates, many homeowners could refinance several times. The low-interest rates also allowed many people to buy residential and rental properties, creating a housing boom.

The 2000s saw a broad decline in mortgage rates. 30-year fixed-rate mortgages stayed between 5 and 6% for most of the decade after hitting those values in 2003. The 2000s saw changes in the mortgage industry as the housing market witnessed historic lows. This situation fueled a system of higher borrowing, and risk-taking, causing the subprime market to grow. These conditions culminated in the housing and financial crisis in 2008.

Due to the crisis, many homeowners defaulted payments on their loans, leaving banks with many repossessed properties. To compensate for their losses, banks started charging higher interest rates on new loans, making it more difficult for people to get mortgages and reducing the property market. Prices started to drop as fewer people bought properties. However, the housing market started to rebound in the 2010s. During this time, the average 30-year fixed-rate mortgage saw a record low of 3.32% and a high of 5.21%.

The housing market has experienced many ups and downs in the 2020s, particularly influenced by the COVID pandemic. However, this decade has seen mortgage rates drop to their lowest in history.

Average 30-year fixed mortgage rates since the 1970s (note that the actual rates for investment properties have been historically higher by 0.5-1% (Source: FRED Economic Data)

How are current investment property rates calculated?

The lender’s valuation does not entirely determine the rates you pay on your mortgage. Mortgage lenders typically have to adjust their rates to meet Fannie Mae and Freddie Mac’s rules.

Fannie Mae and Freddie Mac regulate the mortgage market today and set fees for property lenders. Lenders who give loans for investment properties are typically charged more, and this higher charge trickles down to the final borrower as a higher interest rate.

The increase in interest rate varies according to the number of units within the property. For a 1-unit property, there’s a typical interest rate increase of 0.5 to 0.75% on the current rate for residential mortgages. Meanwhile, for investment properties of 2-4 units, the interest rate increases by 0.525-1%.

How to get a lower investment property mortgage rate

The average rate on investment properties is typically higher than that on residential properties. However, there are actions that you can take to boost your chances of getting a good mortgage rate regardless of the lender you use. These actions include;

- Boosting your credit score: Your credit says a lot about your financial situation and capabilities. While many lenders may offer you investment property loans with a 640 credit score, you typically won’t get a good rate. The best way to improve your chances of getting a good rate is by increasing your credit score to 700 or higher. With a credit score of about 740, you can enjoy mortgage rates similar to residential property rates.

- Make larger down payments: investment property loans require that you make a down payment of about 15%. However, a minimum down payment will typically attract higher rates. The best way to get a better rate is by making a higher down payment. The higher your payment, the lower the rates you enjoy.

- Have a better debt-to-income (DTI) ratio: Debt to income ratio measures your monthly debt against your monthly income. The DTI informs a lender of your financial situation and ability to make monthly payments. For investment property loans, the minimum allowable DTI is 36%. However, a lower DTI will significantly boost your chances of having lower rates.

- Increase your cash reserves: Investment properties may not always generate income. You may struggle to get tenants into the house, or your tenants may struggle to keep up with their rent. Thus, lenders require that you have adequate cash reserves to make monthly mortgage payments even if the property does not generate income. Lenders typically request cash reserves adequate to cover 6 months of payment. However, with more cash reserves comes better security for the lenders and, thus, better rates for you.

How to get the best mortgage rates

Before taking an investment property loan, getting a good mortgage rate is important. Not just a good rate, but the best rate around. The lower the mortgage rate, the less you spend overall.

You can get the best rates by comparing different lenders in your locale. There are two ways to compare lenders;

- Utilize the internet: The internet contains a wealth of information about different lenders and their rates. Through the internet, you can get a direct line to loan officers to make inquiries and discuss what you are looking for.

- Ask landlords in your locale: Another good way, and probably the best, to compare different lenders is to ask the landlords in your area. Inquiring this way will give you full insights into the intricacies of each lender. You can compare each lending company’s service delivery, closing rates, hidden fees, and general conduct.

However, it’s not only about finding the lender with the best rates. Rates vary according to the type of loan you want and factors like your credit score and down payment.

After choosing a lender, you have to choose the type of loan you want. For instance, you could opt for a fixed-rate mortgage or an adjustable-rate mortgage (ARM). ARMs typically provide lower initial rates. However, after a while, such rates typically rise. The interest rate on a fixed-rate loan is often a little higher. However, that rate is set for the whole term of your loan.

When comparing lenders, start by comparing similar loan types between each. Apply for prequalification at several lenders instead of simply reading about rates online. Lenders determine your mortgage rate based on personal characteristics such as your credit score and down payment when you apply for pre-qualification. This can enable you to compare several lenders with greater accuracy.

It’s crucial to compare mortgage lenders quickly—generally within 45 days — to get the best deal. Within this time span, you can submit an application to any number of lenders. Each lender you apply to offers a loan estimate. The conditions and costs of a loan are detailed in this document. It covers the interest rate, closing costs, and additional fees like private mortgage insurance (PMI). To determine which offers you the best overall value, ensure that you examine all these fees and prices.

If you find a mortgage rate you are satisfied with and can make the monthly payments, you should lock it in. A mortgage rate lock guarantees your interest rate for a specific time, usually up until the closing date.

In conclusion

Before taking out an investment property mortgage, you should consider if your potential rental income from the property matches the higher interest rates you will pay. You should also consider the economic situation and policies that affect mortgage rates. Different lenders offer different rates, so it is important that you compare different lenders to find the best rates. However, your overall tendency to get good rates depends on criteria like having better credit scores and higher down payments. Looking for the best rates on investment property mortgages? Then look to Aurum & Sharpe. We are a top mortgage broker serving many states across the U.S. With over 29 years of experience, we have helped numerous clients enjoy hassle-free journeys to becoming landlords. Our services range from non-QM loans to refinancing for investment properties. We guarantee the most competitive rates on the market while offering splendid service. So pick up your phone now and contact us at 9177404325 to book an appointment, or use the online form to get in touch.

Mortgage Rates

Mixed Use: 7.685

Office: 7.685

Retail: 7.685

2-4 Units: 7.685

Multi-Family: 7.685

Portfolio of 2-4 family homes: 7.685

single family: 7.685

portfolio of single family homes: 7.685

Calculate Your Monthly Payment

Mortgage Information

Monthly Payment

Principal and Interest: $0

Total Monthly Payment: $0