15 or 30 Year Mortgage for Investment Property

September 30, 2022- Applying for an Investment Property Mortgage in New York

- Buying Investment Properties In New York

- Mortgage Rates for Investment Properties in New York

- Top New York cities to buy investment properties

- What are investment properties?

- What are some characteristics of investment property mortgages in New York?

- What are the current mortgage rates on investment properties in New York?

- What Types of Mortgages Are Available In New York

Also known as the “big apple,” New York is touted as “the city that never sleeps.” A concrete jungle where dreams are made, and people form from the school of hard knocks. It’s said that if you can make it in New York, you can make it anywhere on earth – but first, you need to make it in New York.

Making it in New York often requires that you have investments. These can be stocks, mutual funds, real estate, or whatever tickles your fancy. Like in any other place, you typically need a mortgage to invest in New York real estate. However, New York isn’t quite like any other place – Things are “extra” over here, and mortgage rates aren’t quite the same. Before taking a mortgage in New York, you must calculate how much it will cost, especially in the long term.

This piece provides all the information you need about taking an investment property mortgage in New York, including interest rates, tax payments, and some of the best investment mortgage lenders in the city.

What are Investment Properties?

Property bought with the intention of making a profit, whether through rental income, capital return (price appreciation), or a mix of the two, is referred to as an investment property. Individual investors, groups of investors, or corporations may own the property.

Long-term or short-term investments may be made on investment properties.Short-term investments involve the owners flipping the property. Flipping involves purchasing real estate, renovating it, and selling it for a profit. However, if you keep an investment property for a long time, you’ll probably reap the rewards of price growth and rental income. Investment properties may include single-unit condominiums, multi-family housing units, large apartments, office buildings, etc.

Buying Investment Properties In New York

Buying a property in the Empire state can be tricky. Rising inflation and construction costs have caused a low housing supply. In turn, the bidding on the available properties is super competitive, and prices have skyrocketed. Currently, many New Yorkers can not afford to buy residential properties, and the statistics are worse for investment properties.

The prolonged scarcity of properties, coupled with high property prices, has impeded the New York real estate market. New York has a homeownership rate of 54.1%, lower than the national average of 64.4%. By mid-2022, there were just 38,966 properties available in New York, down from 45,441 in 2021. In addition, the median sales price in New York jumped to $428,825, up 13.1% from $379,000 last year. New York’s housing affordability index decreased by 31.3%, from 127 last year to 90 this year. As a result, many prospective homebuyers are no longer eligible for mortgages or cannot afford to buy a property in the current economic climate.

Still, New York is a unique location. Unlike other states where higher housing prices slow down housing demands, the opposite is the case in New York. Many home buyers are willing to overlook the high rates to get the limited number of properties in the state.

Buying an investment property in New York can be especially rewarding if you can afford it. You can benefit from equity growth that ensures you sell for a massive profit in the future. But more importantly, you can benefit from passive income through rent payments. Average rent in New York continues to soar, with median rent reaching about $3,400 in mid-2022. Thus, playing your cards right puts you in the front seat as one of the biggest winners in New York’s volatile real estate market. But first, you must understand the intricacies of taking an investment property mortgage in the state.

What Types of Mortgages Are Available In New York

New York real estate offers home buyers a variety of mortgage options. Before buying an investment property, it is important that you understand the various options before taking a mortgage for an investment property in New York. Conventional loans and jumbo loans are some of the most popular mortgage programs for investment properties in New York. The down payment, debt-to-income ratio, and credit score restrictions vary depending on the program. Here is some information about each;

Conventional Mortgages

A conventional mortgage is the standard loan for residential and investment properties. These mortgages aren’t backed by the government and conform to Fannie Mae and Freddie Mac regulations. With a credit score of at least 620 and a debt-to-income ratio of 45 percent or less, you’ll likely qualify for a conventional residential property loan. However, for an investment property mortgage, you will need a credit score of 680 or more and a DTI of 36% or less. You will also be required to make a larger down payment of at least 20% of the home’s purchase price, usually around 25-30%. Not every bank, credit union, and online lender offers conventional loans for investment properties. So you have to properly research and compare rates. You can get a 15-year fixed term, 30-year fixed term, and adjustable rate mortgage options for conventional loans

Jumbo Loans

If the investment property you want to buy is very expensive, typically between $650,000 and $3 million, you will need a jumbo loan to make this purchase. A jumbo loan is a mortgage loan that exceeds the limits set by the Federal Housing Finance Agency (FHFA). Jumbo loans are called non-conforming loans because they don’t conform to these limits. To qualify for a jumbo loan on investment property, you’ll need a minimum credit score of at least 700, 12 months of cash reserves, and a minimum down payment of 20%.

Lenders might charge higher interest rates on jumbo loans since there’s so much risk involved. However, this is not always the case. Jumbo loan interest rates are typically 0.25 – 1% higher than conventional loans. Taking a jumbo loan for a residential or investment property isn’t much different, and both options are often classed together You can get a 15-year fixed term, 30-year fixed term, and adjustable rate mortgage options for jumbo loans

Hard Money Loans

If your goal is to quickly flip a property for profit in the New York real estate market, then a hard money loan might work for you. Hard money loans are offered by independent investors/private individuals. Hard money loans are often seen as a loan of last resort. They have some advantages but also have their downsides.

Some advantages of hard money loans include their ease of obtaining. They have more lenient requirements as investors may be more concerned about the property’s potential rather than your credit score. On the flip side, hard money loans typically have a higher down payment (25% at least), higher interest rates (between 11 and 13%), and shorter terms (typically 18 to 36 months). Hard money loans are best when you need a quick loan to flip a property and cannot wait through the rigors of a conventional or jumbo loan.

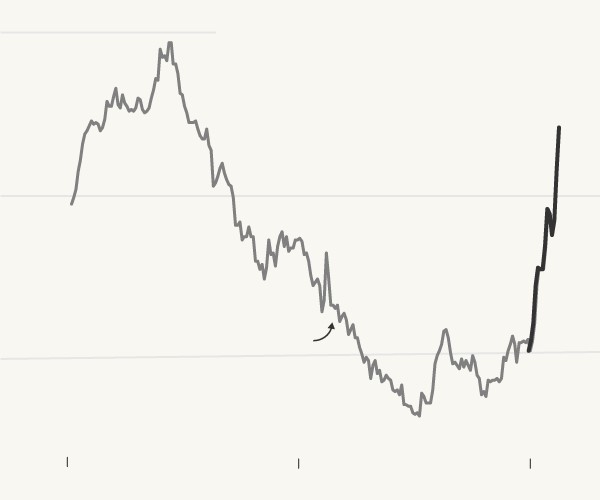

What are the current mortgage rates on investment properties in New York?

Current rates in New York are 6.375% for a 30-year fixed and 5.75% for a 15-year fixed conventional mortgage. However, these rates apply to residential properties. They also apply if you have a very good credit score and make a large down payment. For investment properties, the average mortgage rates increase by 0.5-0,75%. Thus, the average mortgage rates for New York investment properties will be 6.875-7.125% for a 30-year fixed mortgage and 6.25-6.5% for a 15-year fixed mortgage. You may pay higher mortgage rates if you have lower credit scores.

The exact rates may be higher or lower, depending on the lender. Thus, you must search properly and compare the rates offered by different New York lenders. The table below compares the average rates for different investment property mortgage options in New York. The Annual Percentage Rate (APR) represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after the closing date for adjustable-rate mortgage (ARM) loans.

| Mortgage Type | Intrest Rate | APR |

| Conventional Loan | ||

| 30-year fixed | 7% | 7.182% |

| 15-year fixed | 6.375% | 6.65% |

| 10-year fixed | 6.375% | 6.65% |

| 7-year ARM | 5.75% | 6.89% |

| 5-year ARM | 6% | 7.18% |

| Jumbo Loans | ||

| 30-year fixed | 6.57% | 6.65% |

| 15-year fixed | 6.18% | 6.37% |

| 7-year ARM | 5.96% | 7.15% |

| 5-year ARM | 5.695 | 6.85% |

Applying for an Investment Property Mortgage in New York

Being as prepared as you can is helpful when applying for a mortgage in New York. Check your credit profile first, make any necessary corrections, and note any weak points. While preparing to purchase an investment property, improve your credit whenever possible and avoid taking out any new loans or other significant financial commitments.

Before submitting a mortgage application, estimating roughly how much house you can afford is always a good idea. You can use an online affordability calculator to determine what properties are within your budget range. Remember that the housing market in New York changes rather rapidly, so be sure to make your estimations very close to when you are ready to purchase the property.

Learn about the many types of mortgages and determine which would be ideal for you. You should also start monitoring the regularly fluctuating mortgage rates to get a feel of the current state of the market.

Finally, compile all the necessary paperwork for your application, such as a summary of your assets and liabilities and proof of income. For investment properties, you will also need documents pertaining to the lease agreement on the property. When you make a mortgage application, many lenders will want to perform an appraisal of your targeted property to ensure that you get the fair market value for it.

Ensure that when comparing rates with different lenders, you also compare their closing costs and other fees (such as appraisal fees) that you will pay during the application. This will give you a true view of the mortgage cost and the overall worth of the investment.

What are some Characteristics of Investment Property Mortgages in New York?

Getting an investment property, and more importantly, an investment property mortgage in New York is very different from what you are used to. However, despite the rising interest rates, an investment property in New York has plenty of advantages. Primarily, New York allows you to command enough rent to pay your mortgage in due time. However, not every New York-based lender is willing to give a loan for an investment property, and those that do often have a catch.

Here are some characteristics of investment property mortgages you will get in New York

They are usually ARMs

Although there are fixed-rate mortgage options for investment properties, you will most likely get an adjustable-rate mortgage. This is because lenders typically have to cover these loans since the federal government does not back investment property loans. These portfolio loans, as they are called, are rarely fixed-rate loans. So you’ll likely get a 7/1 or 5/1 ARM. That means the rates remain fixed for a certain number of years (seven years in the case of 7/1 ARMs) and then adjust yearly to a certain percentage.

They are way harder to qualify for

The minimum required credit score for an investment property at the national level is 680. However, in New York, you typically need a score of 720 to qualify for an investment property mortgage. While 720 qualifies as a good score, this will not even get you a good mortgage rate. Thus, you close to excellent scores for better rates in New York. In addition, New York lenders need you to make higher down payments, typically around 25%, for an investment property. Most lenders also want to see that you have adequate funds to cover six months’ worth of principal, interest, taxes, and insurance.

Owner-occupants can easily qualify

A resident of a home who also owns the property is known as an owner-occupant. On the other hand, an absentee owner has the title to the property but does not reside there. There are no strict requirements for investment property borrowers to occupy their property. However, the building must be at least 51% owner-occupied if you’re buying a condo. This is different in New York, where the building needs to be 30% owner-occupied when buying a condo.

Top New York Cities to buy Investment Properties

While the whole state of New York offers many advantages for investment property buyers, some cities offer many advantages, such as ease of getting tenants, better mortgage rates, better serenity, etc. Here are some of the top New York Cities to buy investment properties.

Long Island

Located in western Queens in New York City, Long Island is a budding residential and business district. Because it’s less expensive than adjacent Manhattan, the city has seen tremendous growth in its real estate market in recent years. However, it is still as expensive as most places in Queens.

The median home cost in Long Island by mid-2022 was $1.3 million, while residential and commercial rents significantly increased over 2021. Thus, Long Island presents itself as an awesome location for investment property buyers to pitch their tents.

Otisville

When you consider that New York City is only 90 minutes away, real estate in Otisville seems cheap. Properties in Otisville start at just $78,000, with a median listing price of around $299,000. Older properties are common in Otisville, enabling investors to fix and flip. Otisville also has the highest long-term cap rates among all real estate markets in New York. These properties make Otisville one of the top locations in New York to invest in multifamily properties.

Rochester

With almost a million residents, Rochester ranks fourth in terms of population in New York. Rochester offers investors a range of single-family and multifamily properties in terms of real estate. These homes range in price from $10,000 to $2.1 million, with median prices reaching around $167,500.

The housing market in Rochester is hot, so there is strong demand for the available properties. Moreso, many Rochester residents rent their homes, with 60% living in rented apartments. Thus, Rochester presents a solid market for investment property buyers as there is a big chance of them recouping their money and even striking profits.

Bottom Line

The COVID pandemic hit New York hard and swayed the real estate market. Today, we see a decrease in available houses, but uniquely, an increase in demand. This unique behavior in New York real estate drives prices up, and more so, mortgage rates.

Not many in New York can afford the expensive mortgage, which is currently around 5.7% for a 7/1 ARM loan for an investment property. However, those that can yield plenty of rewards. Be sure to monitor the rates closely, and compare rates between different lenders before entering the New York market.

Looking for the best rates on investment property mortgages? Then look to Aurum & Sharpe. We are a top mortgage broker serving many states across the U.S, including New York. Over the years, we have helped numerous clients enjoy hassle-free journeys to becoming landlords. Our services range from non-QM loans to refinancing for investment properties. We guarantee the most competitive rates on the market while offering splendid service. So pick up your phone now and contact us at 9177404325 to book an appointment, or use the online form to get in touch.

Mortgage Rates

DSCR Mortgage: 7.375%

Commercial Mortgage: 7.5%

Single family, Condo Investment Property: 7.375%

Portfolio of Residential Homes: 7.5%

Calculate Your Monthly Payment

Mortgage Information

Monthly Payment

Principal and Interest: $0

Total Monthly Payment: $0