Investment Property Mortgage Rates

Best way to get a Mortgage for Investment Properties over $3,000,000

October 4, 2022

An investment property mortgage is a loan obtained to fund an asset with the potential to generate income. The best way to profit from real estate is through investment properties. Investment properties are purchased to rent out or sell for a profit, unlike primary. Investors can fund the acquisition or construction of investment properties with the aid of loans. Investment mortgages—also referred to as loans for rental property—are backed by the asset being financed. In other words, if you don’t comply with the loan agreements, the lender has the power to foreclose on your home.

Investment property loans come in various forms, such as conventional loans, hard money loans, private money loans, and home equity/HELOC loans. Each loan has a distinct feature, prerequisites, advantages, and disadvantages. But one thing all these loans have in common is that their rates are frequently higher than those for home mortgages. Purchasing an investment property is vastly different than purchasing a home. Investing in real estate is often riskier for lenders than buying a home. As a result, these lenders often impose stricter investment mortgage restrictions. This article will provide all the information you need regarding mortgage rates for investment properties.

Investment Property Mortgage Rates

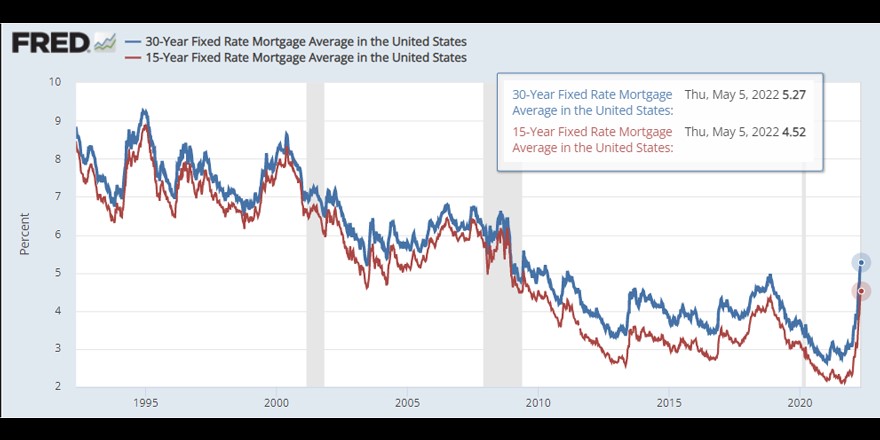

Mortgage interest rates for investment properties are the interest rates that lenders demand loans for investment properties. This interest is the annual cost of the loan and is represented as a percentage of the principal. The rate you will receive depends on your financial situation, the amount of your down payment, and your credit score. When lending money to investors in investment properties, lenders take on a larger risk, which is offset by the higher interest rate. Various factors influence the actual interest rate of an investment mortgage. The loan rate is often lowered by larger down payments, better credit scores, and shorter durations.

The mortgage rate will also depend on the lender you choose and the sort of investment loan you acquire. For instance, compared to other loan kinds, hard money loans often have greater interest rates. In essence, the higher your credit score and the more down payment you can afford, the better and lower your rate. Mortgage rates can be either fixed or adjustable. Fixed mortgage rates are exactly what their name suggests—they don’t change throughout the loan.

As a result, these rates might not truly depict those of the current market. For instance, if your interest rate is fixed at 4%, and market interest rates drop to 3.5%, you will still be required to pay 4% toward your mortgage. Your interest rate changes over time with an adjustable-rate mortgage to match the rates offered in the market. However, each rate structures have advantages and disadvantages.

Usually, the rates are .50 to.75 percent more for investment properties than homes. For instance, if the interest rate for a 30-year fixed-rate mortgage on a primary home is approximately 3.5%, the interest rate on a 30-year loan for investment property will vary between 4.0% and 4.25%.

Comparing Primary Homes and Investment Property Loan Rates

Lenders specializing in financing investment properties want to ensure that potential borrowers have good credit and can meet the financial obligations associated with buying an investment property. It’s crucial to understand that the mortgage procedure won’t be the same as when you bought your primary residence, and it’ll probably cost you more if you decide to purchase an investment property.

Let’s examine borrowing rates on primary residences to those on investment properties to see how they compare.

| Factors | Investment Properties | Primary Home |

| Loan amount | $500,000 | $500,000 |

| The monthly payment for principal and interest | $ 2,315.58 | $2,176.03 |

| Interest rate | 3.75% | 3.25% |

| Total Interest Paid | $ 333,608.06 | $283,371.37 |

According to the data, a loan for investment property carries a higher interest rate, which results in a monthly mortgage payment of around $56 greater than one for a permanent dwelling. In addition, the overall interest paid throughout the loan is over $20,000.

How to get a Lower Investment Property Mortgage Rate

When applying for an investment property loan, you need to consider your factors, as they determine the mortgage rate you are likely to get on your loan. The following will help you get a better and lower mortgage rate on your investment property.

- Have a good credit score: To be eligible for an investment property mortgage, you must have a credit score of at least 640. However, a lower score won’t offer you the best interest rates or allow you to pay less down the front. A 700 or better is the desired score.

- Make a larger down payment: By making a larger down payment than required, you can borrow less money and lower the risk to your lender. Make a larger deposit than 20% if possible.

- Reduce your existing debt: When comparing your monthly debt payments to your monthly gross income, your debt-to-income ratio, or DTI, shouldn’t typically be higher than 43%. To meet the mortgage payment for an investment property, you will need a lot of space in your budget, albeit you may consider up to 75% of your expected rental revenue. Keep in mind that a rental property also has additional costs, such as those upkeep, renovations, homeowners insurance, property taxes, and tenant screening fees.

- Boost your cash reserves: After paying your down payment and closing charges, you should have some liquid assets on hand, called cash reserves. For investment homes, lenders often require cash reserves equal to at least six months’ worth of mortgage payments and might be more. The excess cash reserve demonstrates you will have enough cash on hand to cover repayments when your rental property is vacant, which is important because investing in real estate may be risky.

Types of Investment Property Mortgage Loans and their Rates

Different loans have different rates. However, we will look at different loan types and their rates respectively.

1. Owner-Occupied Multifamily Loans (House Hacking)

The most affordable mortgage loans are offered to homeowners. A homeowner’s mortgage can be used to purchase a home, which you could then occupy for a year before leaving and renting out. However, house hacking is a more effective way to quickly increase the value of your real estate holdings. Purchasing a 2-4 apartment building and relocating into one of the units is “house hacking” a multifamily property.

The remaining units are rented out through a long-term tenancy agreement or short-term Airbnb rentals. In an ideal situation, your rental revenue would pay for your mortgage and potential maintenance and repair expenses. A conventional homeowner mortgage is the best option. You can either start afresh in a single-family home or relocate after a year if you want to.

You can also use house hacking to complete spaces that can be rented independently, such as basements or lofts, add more dwellings to a property (for example, guest houses), or build houses with multiple bedrooms where you can rent out additional bedrooms to tenants. A reduced down payment is another benefit of an owner-occupied loan and cheaper interest rates. When using a Fannie Mae loan to home hack, the rate may be as low as 3%.

Current Owner-Occupied Mortgage Rates

- 15-Year Fixed Interest: 4.50% – 5.99%

- 30-Year Fixed Interest: 5.25% – 6.99%

Pros

- Investment property loans at the lowest interest rates feasible

- Loans with the least amount of required down payment for investment properties

Cons

- Limited scalability: most lenders only permit four mortgage loans to appear on your credit report

- You’ll live nearby or with your tenants.

2. Conventional Rental Property Mortgages

When considering financing for investment properties, most beginner real estate investors start by looking into conventional mortgages. However, these lenders have a cap on how many mortgages appear on your credit report. Once four mortgages are shown on your credit report, lenders often cease making loans to you. Consequently, conventional loans for investment properties are suitable for your one or two rental properties but are not expandable. For conventional loans for investment homes, you should budget a down payment of 20% to 30%.

Current Conventional Rental Property Mortgage Rates:

- 15-Year Fixed-Rate Loan: 6.0% – 7.49%

- 30-Year Fixed-Rate Loan: 6.37% – 8.0%

Pros

- They are usually less expensive than those offered by portfolio lenders.

Cons

- Most lenders only permit four home loans to appear on your credit report, which isn’t scalable.

- Conventional real estate investor loans are recorded by credit bureaus, and having too many mortgages on your report will seriously damage your credit.

- Mortgage loans are typically not accessible to LLCs and other legal entities.

- Most loans require a minimum credit score of 620, and many are even higher.

- Lenders double-check your tax records and debt-to-income ratio.

- Slow to settle: usually takes at least 30 days

- Stressful with lots of paperwork

3. Portfolio and Hard Money Loans

Unlike conventional lenders, portfolio lenders don’t sell your loan instantly after closing. They rather maintain the loans in their portfolios. The large percentage also provides quick hard money loans for acquiring and remodeling fixer-uppers. As a result, investors who use the BRRRR approach frequently have the option of refinancing their hard money loan with the same lender into a long-term portfolio loan.

Real estate investment loans are available from portfolio lenders at competitive rates. Since they rely on lending decisions on collateral, they are more concerned with scrutinizing the property than with you, the borrower. Most of the time, they don’t need proof of income. Your credit score is important, though. The higher your credit score, the lesser your interest rate and down payment, and the more approval you will get from lenders.

Although you could still be able to secure a loan for an investment property if you have bad credit, you should start working on it to open up more possibilities and lower interest rates. Typically, down payments for loans from portfolio lenders range between 20–30%, just like those from traditional lenders. Community neighborhood banks and credit unions also provide rental home loan portfolios; conduct your research if you’re interested in comparing rates with the different lenders.

Current Mortgage for Rental Property Rates

- Adjustable Rate Mortgages (ARMs): 6.5% – 9.9%

- 30-Year Fixed Interest Loans: 6.75% – 9.9%

- Short-Term Fix & Flip Loans: 7.9% – 14%

Pros

- Scalable: There is no cap on the number of mortgages

- Don’t report to the credit bureaus

- Loans to LLCs and other legal entities are permitted

- Quick: most can settle in 10 to 21 days.

- Many lenders don’t need proof of income.

- Permit purchase-rehab loans.

Cons

- Usually more costly than conventional loans with competitive rates

- Requires good credit. Most call for a minimum score of 620 and even 680.

4. Private Loan

An endless amount of capital is available to experience real estate investors through private loans from individuals. You have the maximum versatility with these loans from family and friends. Everything from charges to mortgage rates and loan terms is subject to direct negotiation with the lender.

Owners of investment properties might experience higher interest rates, but they could also save money by avoiding origination points and closing trash costs. Even if it doesn’t increase your monthly cash flow, this lowers your overall borrowing costs. They might not request a copy of your credit record or proof of income if they trust you. Private loans can be scaled continuously and don’t record to credit bureaus. Defaulting, however, puts your reputation and close relationships in jeopardy.

Private Loan Interest Rates

This is negotiated between you and your lender.

Pros

- Scalable: There is no borrowing cap

- Don’t report to the credit bureaus

- The possible absence of points or up-front loan fees in closing expenses

- Don’t restrict loans to LLCs and other legal organizations

- Quick: You might be able to settle instantly

- No credit score requirements

- There is no need for proof of income.

- Flexible loan term

Cons

- Before requesting personal loans, you must demonstrate your real estate investments’ success.

- There is a chance that this will harm your reputation and personal connections.

5. Seller Financing (Owner Financing)

Seller financing means that you are borrowing from the seller. Many sellers respond to the owner financing proposal after thoroughly discussing it because they might not have come up with it independently. You pay your monthly mortgage to them in compliance with the loan terms you have negotiated, and they keep the promissory note. This type of loan is also negotiable.

You can offer the seller a balloon mortgage since many are unwilling to keep the note for the next 30 years. You might agree on a shorter time frame for repaying the principal when you use a balloon loan. Consider a scenario in which the seller receives a free-and-clear inheritance from a relative but lacks the funds to make necessary improvements. They offer you owner financing and convert the building into a revenue source rather than paying taxes and other charges for an empty property they can’t live in or lease out.

You may agree to a 30-year loan term with a five-year balloon payment at a 6% interest rate. In other words, you pay the owner the remaining sum in full every month after five years by either selling the property or refinancing it. Consequently, you pay the owner’s monthly repayments as though it were a 30-year fixed mortgage at 6%.

Seller Interest Rates

They are between 4-10%.

Pros

- Faster closing: You won’t have to wait for the bank loan officer, underwriter, or legal department.

- Cheaper closing

- Flexible down payment

- No credit score requirements

Cons

- Higher interest

- Need seller approval

- Due-on-sale clause

- Balloon payments

- Owner financing isn’t always an option because many sellers aren’t receptive to it.

What are the Current Investment Property Mortgage Rates?

Investment property rates are typically at least 0.5% to 0.75% higher than standard rates. Therefore, buyers should project loan rates to start at 6.5% to 6.75% (6.572 – 6.822% APR) for a single-unit investment property at the current average rate of 6% (6.072% APR) for a residential property.

You should be aware that the current average rates are contingent on an excellent borrower profile, which includes a credit score of 740 and a 30% down payment. The higher your credit score and down payment, the lower your mortgage rate. In light of this, average rates should only be used as a reference. Considering that the interest rate on your individual investment property will vary, it’s important to check quotations from many lenders to obtain the best offer.

Conclusion

Obtaining financing for an investment property can be a challenging and confusing process. As a result, most real estate beginners lack direction while investing. As mentioned above, an ideal entry point toward rental property investing is house hacking. The sole requirement is that you occupy it for a year, but you are still permitted to own multifamily real estate. You can also get low-interest rates from conventional loans, but they are not scalable due to severe restrictions on the number of mortgages that can appear on your credit report.

Seeking financing for investment homes will require ingenuity if you are passionate about expanding your portfolio. Looking for the best rates on investment property mortgages? Then look to Aurum & Sharpe. We guarantee the most competitive rates on the market while offering splendid service. To get started, contact us at 9177404325 to book an appointment or use the online form to get in touch.

Mortgage Rates

DSCR Mortgage: 7.375%

Commercial Mortgage: 7.5%

Single family, Condo Investment Property: 7.375%

Portfolio of Residential Homes: 7.5%

Calculate Your Monthly Payment

Mortgage Information

Monthly Payment

Principal and Interest: $0

Total Monthly Payment: $0