Over the years, we’ve developed a specialty in writing mortgages for portfolios of single family and 2-4 unit properties. One of our largest was a cash out refinance of 120 single family homes in Florida that totaled around $20,000,000.

We’ve learned that when writing mortgages for portfolios and blanket loans, the most important thing is being able to close. Period. These deals have a lot of moving parts and an endless amount of details that could kill your deal. We are about Freedom, Purpose, and Fulfillment here, so the last thing we want is for someone working with us to see all their efforts go down the drain because of something that could be avoided. We know how to overcome the pitfalls and see issues as, or before they arise!

Here are the groups involved that we represented for that $20mm deal:

We even went on our client’s podcast following the deal:

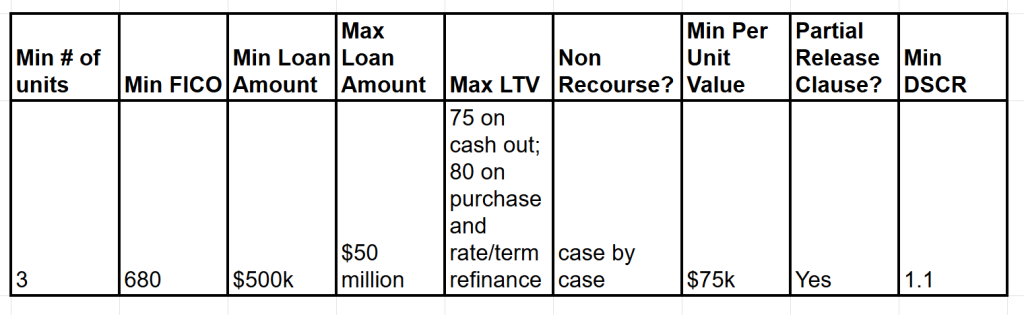

Here are the nuts and bolts of what we can do when it comes to portfolios:

Processing Fee: $995

Brokerage Fee: 1.297% of loan amount

Appraisals: Required- Price depends on number of properties

Post Closing Reserves (How much money you need to have in liquid assets after closing): 9 Months of mortgage payment, taxes, and insurance required

Property Types Accepted: Single Family Residential, Warrantable Condo, Townhome, 2-4 family